WHAT DO WE DO!

At Infinitas Trade, we provide personalized investment solutions tailored to your unique goals. Our experienced portfolio manager considers your tax status, growth or income preferences, specific investments, and ESG considerations to craft a customized portfolio. You’ll have secure online access, regular updates, and annual tax reporting. We prioritize tax efficiency, ensuring direct ownership benefits and seamless transitions. Our Infinitas Income Model Portfolio aims for regular income with potential growth, targeting an average return of 6% above the RBI Cash Rate over 5 years. Join us for a focused, effective investment approach.

Services

TAILORED INVESTMENT

Clients can discuss their taxation status, growth or income expectations, specific investments, environmental, social or governance considerations with our sophisticated portfolio manager. Our portfolio manager will then build a portfolio tailored to meet the client’s investment objectives and requirements and manage it going forward.

All clients have secure online account access, regular portfolio commentary, and annual tax reporting. In addition to the reporting services, the portfolio manager will meet with the client on a regular basis to discuss the portfolio and explain any changes to it.

Services

TAX EFFICIENCY

As each client retains the direct beneficial ownership of their holdings, dividends and franking credits accrue directly to each portfolio and existing holdings can be transferred into their Infinitas portfolio without triggering tax events. Investment management, sell decisions, withdrawals and transitions are made with consideration to the clients’ total tax consequences and status.

Unlike investing in a managed fund, any taxation consequences resulting from a portfolio transaction are quarantined to the individual investor. In a managed fund, there may be embedded capital gains within the unit price that an investor “buys into” when investing in a fund. In addition, the manager may be forced to sell stocks to meet other investors’ redemption requests, resulting in taxation consequences for remaining investors, through no action of their own.

Services

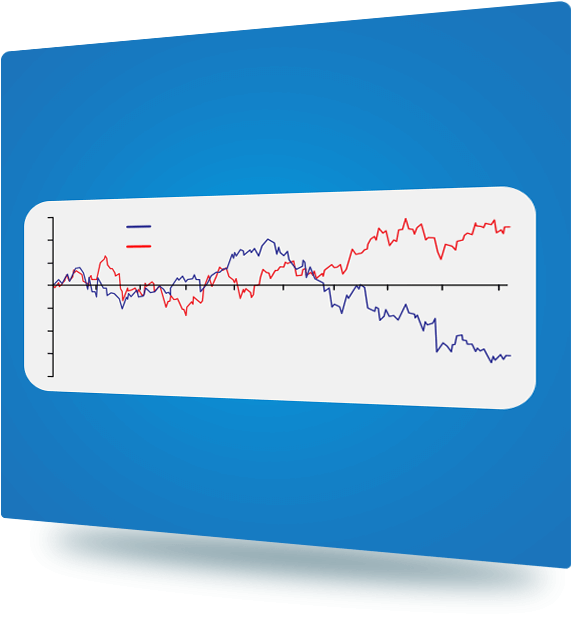

RETURN ON INVESTMENT

The Infinitas Income Model Portfolio aims to provide regular income from a portfolio of corporate bonds, high yield shares, property securities, cash deposits and other income-producing assets. The manager will focus on income generation. The model aims to provide the opportunity for a mix of income with the potential for some capital growth over a 6 Months – 5 Years period. The portfolio manager aims to achieve a return that is on average 6% p.m. above the RBI Cash Rate over rolling 5 years period.